SECURITIES AND EXCHANGE COMMISSION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment

Filed by the Registrant þ☒

Filed by a Party other than the Registrant ¨☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☒ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material Pursuant to §240.14a-12

Matador Resources Company

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒ No fee required.

☐ Fee paid previously with preliminary materials.

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11

| | | | | |

| | 2024 |

¨ | | Preliminary Proxy StatementNotice of Annual Meeting of Shareholders and |

| Proxy Statement |

June 13, 2024 | Dallas, Texas

| | |

|

| ¨

| Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))One Lincoln Centre 5400 LBJ Freeway, Suite 1500 Dallas, Texas 75240 www.matadorresources.com

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS To Be Held on June 13, 2024 |

| |

þ | | Definitive Proxy Statement |

| |

¨ | | Definitive Additional Materials |

| |

¨ | | Soliciting Material Pursuant to §240.14a-12 |

| | | | |

|

To the Matador Resources Company |

(Name Shareholders:

Please join us for the 2024 Annual Meeting of Registrant as Specified In Its Charter) |

|

|

(NameShareholders of Person(s) Filing Proxy Statement, if other thanMatador Resources Company. The meeting will be held at the Registrant) |

|

Payment of Filing Fee (CheckHilton Anatole, Imperial Ballroom, 2201 N. Stemmons Freeway, Dallas, Texas 75207, on Thursday, June 13, 2024, at9:30 a.m., Central Daylight Time.

At the appropriate box): |

| |

þ | | No fee required. |

| |

¨ | | Fee computedmeeting, you will hear a report on table below per Exchange Act Rules 14a-6(i)(1)our business and 0-11. |

| | |

| | 1) | | Title of each class of securities to which transaction applies:

|

| | | | |

| | 2) | | Aggregate number of securities to which transaction applies:

|

| | | | |

| | 3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forthact on the amount on which the filing fee is calculated and state how it was determined):

|

| | | | |

| | 4) | | Proposed maximum aggregate value of transaction:

|

| | | | |

| | 5) | | Total fee paid: |

| | |

| | | | |

| | | | |

| |

¨ | | Fee paid previously with preliminary materials. |

| |

¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | 1) | | Amount Previously Paid:

|

| | | | |

| | 2) | | Form, Schedule or Registration Statement No.:

|

| | | | |

| | 3) | | Filing Party:

|

| | | | |

| | 4) | | Date Filed:

|

| | | | |

One Lincoln Centre

5400 LBJ Freeway, Suite 1500

Dallas, Texas 75240

www.matadorresources.com

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To Be Held on June 9, 2016

To the Matador Resources Company Shareholders:

Please join us for the 2016 Annual Meeting of Shareholders of Matador Resources Company. The meeting will be held at the Westin Galleria, Dallas Ballroom, 13340 Dallas Parkway, Dallas, Texas 75240, on Thursday, June 9, 2016, at 9:30 a.m., Central Daylight Time.

At the meeting, you will hear a report on our business and act on the following matters:

| following matters: (1) | Election of the threefour nominees for director named in the attached Proxy Statement; |

| (2) | Vote to approve the Company’s Amended and Restated Annual Incentive Plan; |

| (3) | Advisory vote to approve the compensation of our named executive officers as described in the attached Proxy Statement; |

| (3)Advisory vote on the frequency of future advisory votes to approve named executive officer compensation; (4) | Ratification of the appointment of KPMG LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2016; |

| 2024; and (5) | Vote on the shareholder proposal set forth in the attached Proxy Statement; and |

| (6) | Any other matters that may properly come before the meeting.

All shareholders of record at the close of business on April 16, 2024 are entitled to vote at the meeting or any postponement or adjournment of the meeting. A list of the shareholders of record is available at the Company’s offices in Dallas, Texas. |

All shareholders of record at the close of business on April 15, 2016 are entitled to vote at the meeting or any postponement or adjournment of the meeting. A list of the shareholders of record is available at the Company’s offices in Dallas, Texas.

|

| By Order of the Board of Directors, |

|

|

Joseph Wm. Foran |

Chairman and Chief Executive Officer |

|

April 26, 2024 |

YOUR VOTE IS IMPORTANT!

Whether or not you will attend the meeting, please vote as promptly as possible by using the Internet or telephone or by signing, dating and returning your proxy card to the address listed on the card.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Shareholders to Be Held on June 13, 2024:

Our Proxy Statement and the Annual Report to Shareholders for the fiscal year ended December 31, 2023 are available for viewing, printing and downloading at https://materials.proxyvote.com/576485. |

April 28, 2016

YOUR VOTE IS IMPORTANT!

Whether or not you will attend the meeting, please vote as promptly as possible by using the Internet or telephone or by signing, dating and returning your proxy card to the address listed on the card.

Important Notice Regarding the Availability of Proxy Materials for the

Annual Meeting of Shareholders to Be Held on June 9, 2016:

Our Proxy Statement and the Annual Report to Shareholders for the fiscal year ended December 31, 2015 are available for viewing, printing and downloading athttps://materials.proxyvote.com/576485.

TABLE OF CONTENTS

1Matador Resources Company |

2024 Proxy Statement

PROXY STATEMENT

Matador Resources Company

5400 LBJ Freeway, Suite 1500

ANNUAL MEETING OF SHAREHOLDERS

To Be Held on June 9, 2016

13, 2024

This Proxy Statement is being mailed on or about April

28, 201626, 2024 to the shareholders of Matador Resources Company (“Matador” or the “Company”) in connection with the solicitation of proxies by the Board of Directors (the “Board”) of the Company to be voted at the Annual Meeting of Shareholders of the Company to be held at the

Westin Galleria, DallasHilton Anatole, Imperial Ballroom,

13340 Dallas Parkway,2201 N. Stemmons Freeway, Dallas, Texas

75240,75207, on June

9, 2016,13, 2024, at 9:30 a.m., Central Daylight Time (the “Annual

Meeting” or the “2024 Annual Meeting”), or at any postponement or adjournment thereof, for the purposes set forth in the accompanying Notice of Annual Meeting of Shareholders. The address of the Company’s principal executive office is One Lincoln Centre, 5400 LBJ Freeway, Suite 1500, Dallas, Texas 75240.

If you are a shareholder of record, you may vote in person by attending the meeting, by completing and returning a proxy by mail or by using the Internet or telephone. You may vote your proxy by mail by marking your vote on the enclosed proxy card and following the instructions on the card. To vote your proxy using the Internet or telephone, see the instructions on the proxy form and have the proxy form available when you access the Internet website or place your telephone call.

The named proxies will vote your shares according to your directions. If you sign and return your proxy but do not make any of the selections, the named proxies will vote your shares: (i) FOR the election of the threefour nominees for director as set forth in this Proxy Statement, (ii) FOR the approval of the Company’s Amended and Restated Annual Incentive Plan, (iii) FOR the approval, on an advisory basis, of the compensation of the Company’s named executive officers as disclosed in this Proxy Statement, (iii) for future advisory votes on named executive officer compensation (the “Frequency Vote”) to occur EVERY YEAR and (iv) FOR the ratification of KPMG LLP as the independent registered public accounting firm of the Company for the year ending December 31, 2016 and (v) AGAINST the shareholder proposal as set forth in this Proxy Statement regarding a majority voting standard for the election of directors. The2024. Your proxy may be revoked at any time before it is exercised by filing with the Company a written revocation addressed to the Corporate Secretary, by executing a proxy bearing a later date or by attending the Annual Meeting and voting in person.

The cost of soliciting proxies will be borne by the Company. In addition to the use of postal services and the Internet, proxies may be solicited by directors, officers and employees of the Company (none of whom will receive any additional compensation for any assistance they may provide in the solicitation of proxies) in person or by telephone.

The outstanding voting securities of the Company consist of

shares ofissued and outstanding common stock,

$0.01 par value

$0.01 per share

(“Common(the “Common Stock”). The record date for the determination of the shareholders entitled to notice of and to vote at the Annual Meeting, or any postponement or adjournment thereof, has been established by the Board as the close of business on April

15, 201616, 2024 (the “Record Date”). As of the Record Date, there were

124,780,249 shares of Common Stock outstanding and entitled to

vote 93,265,146 shares of Common Stock.vote.

The presence, in person or by proxy, of the holders of record of a majority of the outstanding shares entitled to vote is necessary to constitute a quorum for the transaction of business at the Annual Meeting, but if a quorum should not be present, the meeting may be adjourned from time to time until a quorum is obtained. A holder of Common Stock will be entitled to one vote per share on each matter properly brought before the meeting. Cumulative voting is not permitted in the election of directors.

The proxy card provides space for a shareholder to withhold voting forabstain with respect to any or all nominees for the Board. The electionaffirmative vote of directors requires a pluralitymajority of the votes cast by holders of shares present in person or represented by proxy and entitled to vote on the election of directors at the meeting. AllAnnual Meeting is required for the election of each nominee for director. With respect to the election of directors in an uncontested election, such as that being held at the Annual Meeting, “majority of the votes cast” means the number of votes cast “for” the election of such nominee exceeds the number of votes cast “against” such nominee. See “Corporate Governance—Majority Vote in Director Elections” for additional information regarding election of directors.

2Matador Resources Company | 2024 Proxy Statement

With respect to the Frequency Vote, because this vote is non-binding, the choice receiving the greatest number of votes will be considered the frequency recommended by the Company’s shareholders, even if that choice does not receive a majority of the votes.

The other proposals require the affirmative vote of a majority of the shares

of Common Stock present in person or represented by proxy and entitled to vote at the meeting. Shares held by a shareholder who abstains from voting on any or all proposals will be included for the purpose of determining the presence of a quorum.

Votes withheldOther than with respect to the election of

directors and the

Company’s directors will have no effect on the election of the nominees. In the case of the other proposals being submitted for shareholder approval,Frequency Vote, an abstention will effectively count as a vote cast against

such proposal.the remaining proposals. Broker non-votes on any matter as to which the broker has indicated on the proxy that it does not have discretionary authority to vote will be treated as shares not entitled to vote with respect to that

matter and therefore will have no effect upon the approval of such matter. However, such shares will be considered present and entitled to vote for quorum purposes so long as they are entitled to vote on at least one other matter.

3Matador Resources Company | 2024 Proxy Statement

This summary highlights information contained elsewhere in this Proxy Statement. This summary does not contain all of the information that you should consider, and you should read the entire Proxy Statement carefully prior to voting. For more complete information regarding our

20152023 performance, please review our Annual Report on Form 10-K for the year ended December 31,

2015.20162023.

2024 Annual Meeting of StockholdersDate and Time: June 9, 2016, at 9:30 a.m., Central Daylight Time

Location: Westin Galleria, Dallas Ballroom, 13340 Dallas Parkway, Dallas, Texas 75240

Record Date: April 15, 2016

Shareholders

| | | | | | | | | | | | | | | | | | | | |

| DATE AND TIME: | | Voting:LOCATION | | RECORD DATE: | | VOTING: |

| June 13, 2024 at 9:30 a.m., Central Daylight Time | | Hilton Anatole Imperial Ballroom 2201 N. Stemmons Freeway Dallas, Texas 75207 | | April 16, 2024 | | Shareholders as of the close of business on the Record Date are entitled to vote. Each share of Common Stock is entitled to one vote at the Annual Meeting. |

Voting Matters and Board Recommendation

| | | | | |

| Proposal | | | | Board Recommendation |

Proposal

Election of Four Director Nominees (page 15) | | Board

Recommendation

| FOR |

Election of Three Director Nominees to Serve for a Three-Year Term Expiring in 2019 (page 10)

| | | FOR | |

Approval of the Company’s Amended and Restated Annual Incentive Plan (page 29)

| | | FOR | |

Advisory Vote to Approve Named Executive Officer Compensation (page 35)44) | | | FOR | |

Advisory Vote on the Frequency of Future Advisory Votes to Approve Named Executive Officer Compensation (page 45) | 1 YEAR |

Ratification of the Appointment of KPMG LLP as the Company’s Independent Registered Public Accounting Firm for 20162024 (page 37)46) | | | FOR | |

Vote on the Shareholder Proposal Regarding a Majority Voting Standard for the Election of Directors (page 40)

| | | AGAINST | |

2015

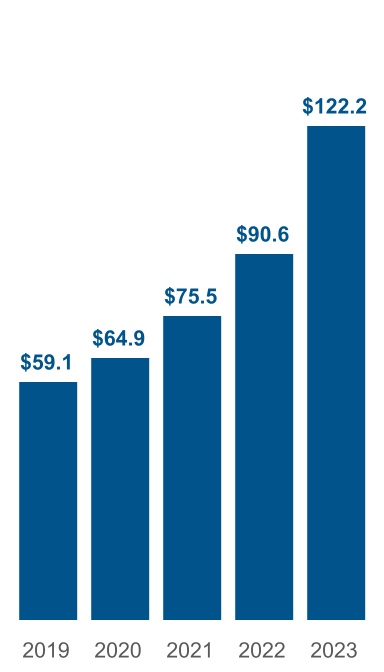

The year 2023 was another outstanding year for Matador, including record oil and natural gas production, steadily decreasing costs and better-than-expected free cash flow. We utilized this free cash flow and the strength of our balance sheet, including over $500 million of cash at the beginning of 2023, to repay borrowings under the Credit Agreement (as defined below), make profitable investments in our oil and natural gas properties and our midstream businesses, including the acquisition of Advance Energy Partners Holdings, LLC (“Advance”), and pay a steadily increasing fixed dividend to our shareholders.

Advance Acquisition

On April 12, 2023, we completed the acquisition of Advance from affiliates of EnCap Investments L.P., including certain oil and natural gas properties, undeveloped acreage and midstream assets located primarily in Lea County, New Mexico and Ward County, Texas (the “Initial Advance Acquisition”). On December 1, 2023, we acquired additional interests from affiliates of EnCap Investments L.P., including overriding royalty interests and royalty interests in certain oil and natural gas properties located primarily in Lea County, New Mexico, most of which were included in the Initial Advance Acquisition (the “Advance Royalty Acquisition" and, together with the Initial Advance Acquisition, the “Advance Acquisition”). The Initial Advance Acquisition added approximately 18,500 net acres in the core of the northern Delaware Basin with approximately 99% of such acreage held by production and provided a significant increase in our drilling inventory with 206 gross (174 net) operated locations in our core target formations and an additional 38 gross (35 net) upside locations in the Wolfcamp D formation. This new acreage also provided further expansion opportunities for Pronto Midstream, LLC (“Pronto”), our wholly-owned midstream subsidiary operating in Lea County, New Mexico.

4Matador Resources Company | 2024 Proxy Statement

Business Highlights

In

2015,part as a result of the Advance Acquisition, Matador

grew its average daily production from approximately 100,000 barrels of oil and natural gas equivalent (“BOE”) per day in early January 2023 to just over 154,000 BOE per day in the fourth quarter of 2023. Matador also achieved record oil

and natural gas

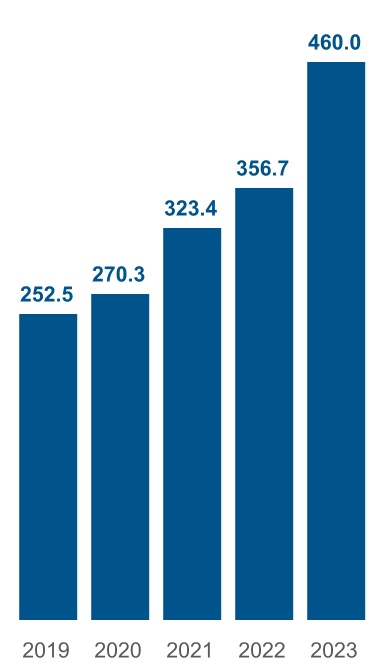

reserves in 2023 as total proved oil and

average daily oil equivalent production. In addition, Matador successfully completed several important transactionsnatural gas reserves increased 29%, or approximately 103.0 million BOE year-over-year, to a record high of 460.0 million BOE, as compared to 357.0 million BOE in

2015, including (i) the merger with Harvey E. Yates Company (“HEYCO”), a subsidiary of HEYCO Energy Group, Inc., which added substantially to Matador’s Delaware Basin acreage position, (ii) Matador’s first issuance of senior unsecured notes, (iii) a follow-on equity offering and (iv) the sale of a portion of Matador’s midstream assets in Loving County, Texas to an affiliate of EnLink Midstream Partners, LP (“EnLink”).Business highlights achieved during 2015 include the following:

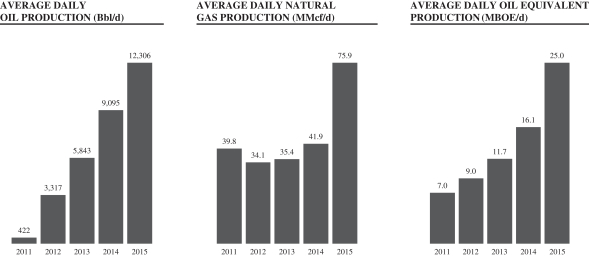

2022.Production Growth

| | | | | | | | | | | | | | |

| 26% | | 24% | | 25% |

| increase in oil production | | increase in natural gas production | | increase in daily oil equivalent production |

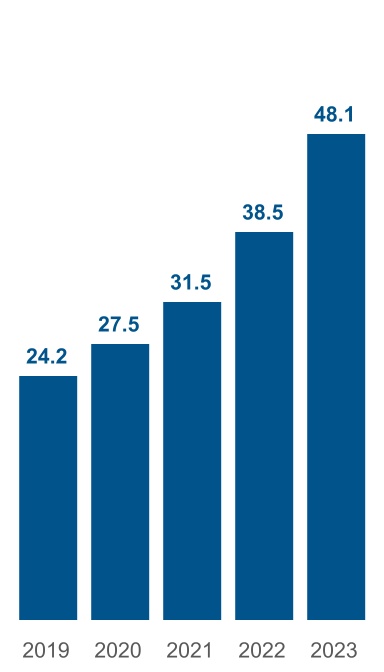

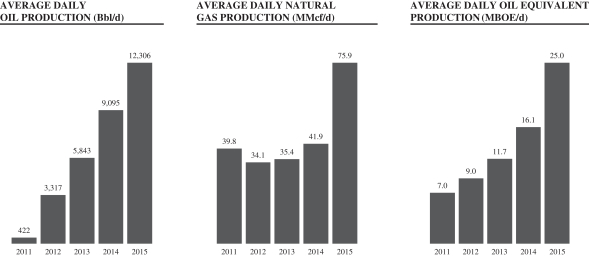

•A 35%26% increase in oil production from 3.3to a record 27.5 million barrels (“Bbl”) of oil produced in 2014 to 4.52023 from 21.9 million Bbl of oil produced in 2015.2022.

•A 24% increase in natural gas production from 15.3to a record 123.4 billion cubic feet (“Bcf”) of natural gas produced in 2014 to 27.72023 from 99.3 Bcf of natural gas produced in 2015.2022.

•A 55%25% increase in average daily oil equivalent production from 16,082 barrels of oil equivalent (“BOE”)to a record 131,813 BOE per day, including 9,09575,457 Bbl of oil per day and 41.9338.1 million cubic feet (“MMcf”) of natural gas per day, in 2014 to 24,9552023, from 105,465 BOE per day, including 12,30660,119 Bbl of oil per day and 75.9272.1 MMcf of natural gas per day, in 2015.2022.

•Continued drilling of longer laterals, with an average completed lateral length for operated wells turned to sales in 2023 of approximately 9,800 feet.

•Capital expenditures for drilling, completing and equipping wells (“D/C/E capital expenditures”) for 2023 of $1.16 billion, which was below our estimated range for 2023 D/C/E capital expenditures of $1.18 to $1.32 billion as provided on February 27, 2015,21, 2023 and was in the middle of the revised estimated range of $1.10 to $1.22 billion, as provided on July 25, 2023.

•Continued focus on increasing efficiency and innovation, including successfully implementing "simul-frac" operations, 100% dual-fuel utilization on Matador completed a business combination pursuant to which onewells and successful execution on our first two "U-turn" two-mile lateral wells.

5Matador Resources Company | 2024 Proxy Statement

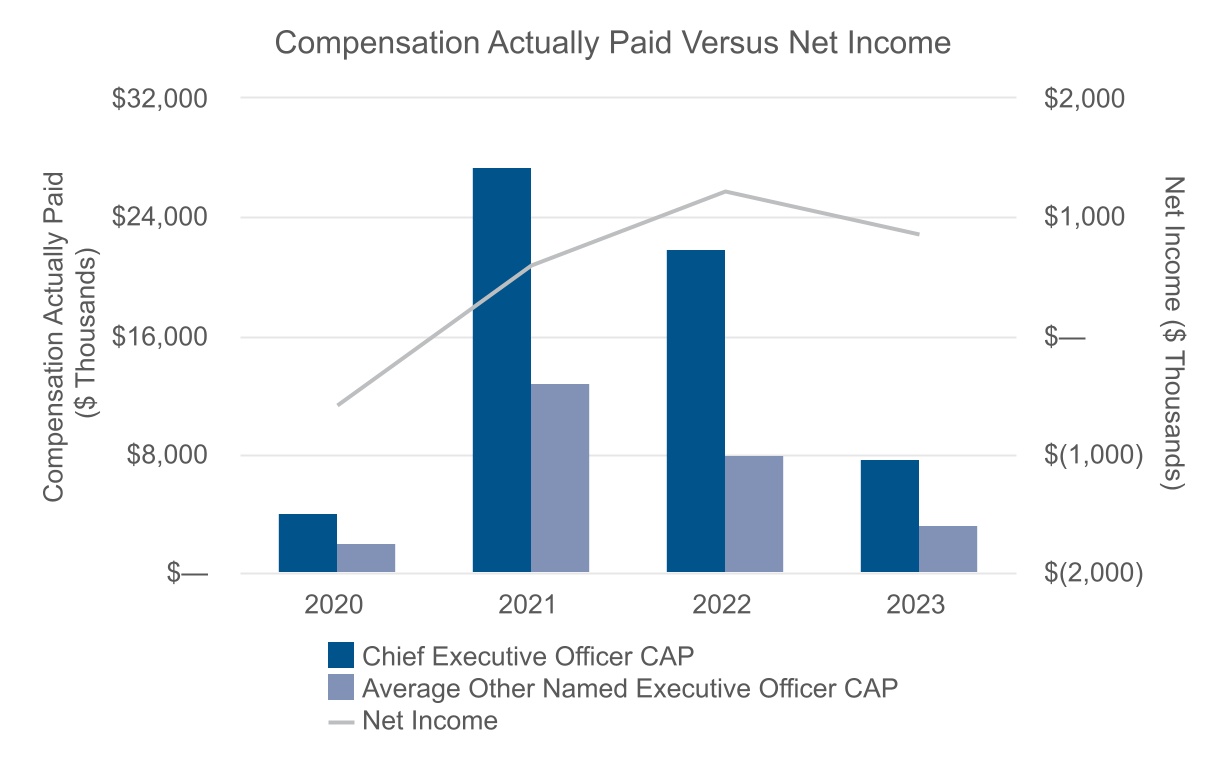

Capital Resources and Financial Highlights

We achieved annual net income of its wholly-owned subsidiaries merged with HEYCO (the “HEYCO Merger”), combining certain$846.0 million and annual Adjusted EBITDA (a non-GAAP financial measure) of $1.85 billion in 2023 despite significantly lower realized weighted average oil and natural gas producing propertiesprices of $77.88 per barrel and undeveloped acreage located$3.25 per Mcf in Lea2023 as compared to $96.32 per barrel and Eddy Counties, New Mexico with$7.98 per Mcf in 2022. San Mateo Midstream, LLC (“San Mateo”), our midstream joint venture, achieved its Delaware Basin operations. Insecond-best annual net income of $131.0 million and record high annual Adjusted EBITDA (a non-GAAP financial measure) of $200.0 million in 2023.

Financial Strength

| | | | | | | | | | | | | | |

| $1.05 Billion | | $0.20 | | $38.2 Million |

| new capital | | dividend per share in the fourth quarter | | performance incentives received from Five Point |

•The generation of free cash flow in all four quarters of 2023.

•The amendment of our dividend policy in the HEYCO Merger, Matador obtained approximately 58,600 gross (18,200 net) acres strategically located between Matador’s existing acreagefourth quarter of 2023, pursuant to which we increased the quarterly cash dividend from $0.15 per share of Common Stock to $0.20 per share of Common Stock.

•The receipt of $38.2 million in its Ranger and Rustler Breaks prospect areas.performance incentives directly from Five Point Energy, LLC, our joint venture partner in San Mateo (“Five Point”).

On April 14, 2015, Matador issued $400.0

•The issuance of $500.0 million of 6.875% senior unsecured notes due 2023 in a private placement and, on October 21, 2015, Matador exchanged all of the privately-placed senior notes for a likeaggregate principal amount of 6.875% senior notes due 2028 (the "2028 Notes").

•The revision of our Fourth Amended and Restated Credit Agreement (the “Credit Agreement”) at our spring and fall redetermination processes to collectively (i) increase the borrowing base to $2.50 billion, as compared to $2.25 billion at December 31, 2022, (ii) increase the elected borrowing commitment to $1.325 billion, as compared to $775.0 million at December 31, 2022, (iii) increase the maximum facility amount to $2.00 billion, as compared to $1.50 billion at December 31, 2022 and (iv) add two new banks to our lending group.

•The amendment of San Mateo’s revolving credit facility (the “San Mateo Credit Facility”) in October 2023 to

(i) increase the lender commitments from $485.0 million to $535.0 million and (ii) add a new bank to San Mateo’s lending group.

6Matador Resources Company | 2024 Proxy Statement

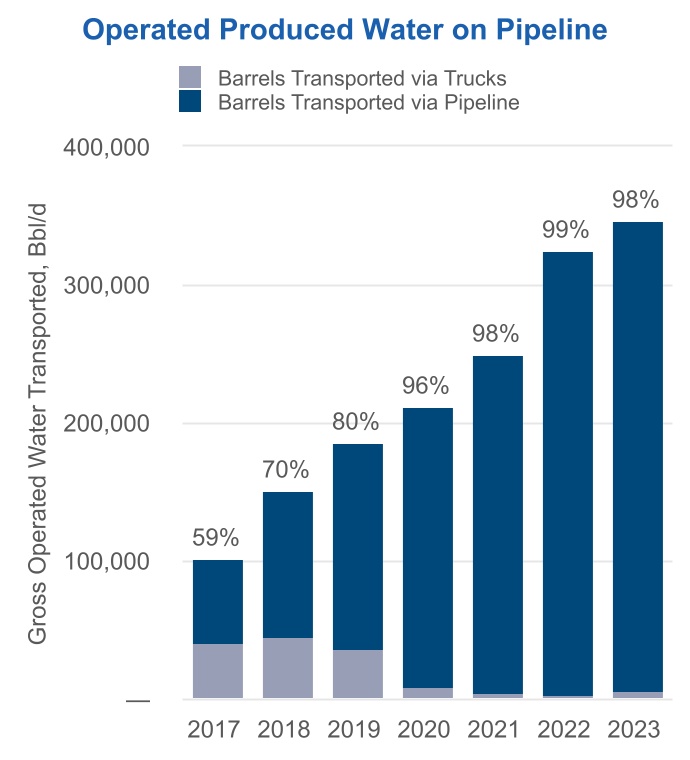

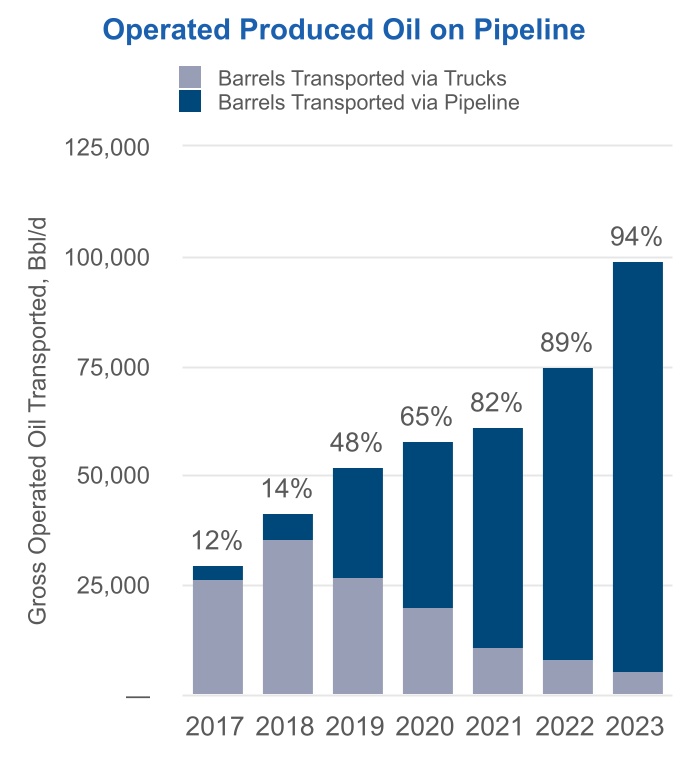

Environmental, Social and Governance (“ESG”) Initiatives (page 33)

At Matador, we are committed to creating long-term value in a responsible manner. Our aim is to reliably and profitably provide the energy that have been registered undersociety needs in a manner that is safe, protects the Securities Act of 1933, as amended.

On April 21, 2015, Matador completed a public offering of 7,000,000 shares of its common stock for net proceeds of approximately $187.6 million.

Onenvironment and is consistent with the industry’s best practices and the highest applicable regulatory and legal standards. In alignment with this goal, we maintain an active ESG program that is overseen and supported by senior management and the Board’s Environmental, Social and Corporate Governance Committee. In October 1, 2015, Matador completed2023, we were pleased to issue Matador’s annual Sustainability Report, which included quantitative metrics aligned with standards developed by an industry leader, the sale of its wholly-owned subsidiary that owned certain natural gas gatheringSustainability Accounting Standards Board (“SASB”). For additional information on the Company’s ESG efforts, see “Corporate Governance—Environmental, Social and processing assetsGovernance (ESG) Initiatives” on page 33. Information included in the Delaware Basin in Loving County, Texas to EnLink for cash consideration of approximately $143.4 million, excluding customary purchase price adjustments.

our Sustainability Report is not incorporated into this Proxy Statement.

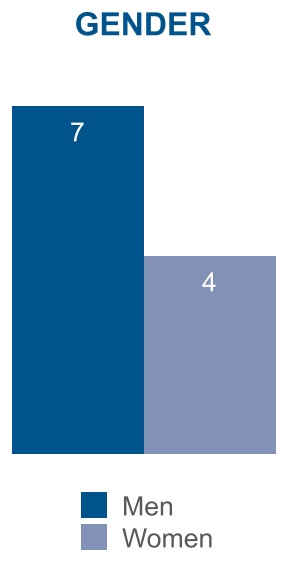

Director Nominees (page 10)15)

Our Board currently has

nine11 members

and is divided into three classes of directors, designated Class I, Class II and Class III. Directors are elected for three-year terms. The table below provides certain summary information about each nominee for director named in this Proxy

Statement. | | | | | | | | |

Name | | Age | | Director Since | | Principal Occupation | | Committee Memberships |

| Gregory E. Mitchell* | | 64 | | 2011 | | President and Chief Executive Officer, Toot’n Totum Food Stores, LLC | | CG |

| Dr. Steven W. Ohnimus* | | 69 | | 2004 | | Retired, Formerly General Manager — Partner Operated Ventures, Unocal Corporation | | A, OP, P |

| | | | |

| Craig T. Burkert* | | 59 | | ** | | Chief Financial Officer, ROMCO Equipment Co. | | ** |

| | | | | | | | | | | | | | | |

| Name | Age | Director Since | Principal Occupation | Committee Memberships | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| William M. Byerley* | 70 | 2016 | Retired Partner, PricewaterhouseCoopers LLP (PwC) | A,ESG,MM | |

| Monika U. Ehrman* | 46 | 2019 | Professor of Law, Southern Methodist University Dedman School of Law | ESG,E,SPC,MM,O,P | |

| | | | | |

| | | | | |

| Kenneth L. Stewart* | 70 | 2017 | Retired EVP, Compliance and Legal Affairs, Children’s Health System of Texas; Retired Partner, Chair—United States, Norton Rose Fulbright US LLP | ESG,E,SPC,CM | |

| Susan M. Ward* | 65 | 2024 | Former Head, M&A and Commercial Finance, Shell Oil Company | A,ESG,MM,P | |

| ** |

| A | Mr. Burkert has not previously served on our Board. We anticipate that Mr. Burkert will be appointed to the Audit Committee following the Annual Meeting. |

ACM | AuditCapital Markets and Finance Committee |

CGE | Executive Committee |

| ESG | Environmental, Social and Corporate Governance Committee |

OPMM | Midstream and Marketing Committee |

| O | Operations and Engineering Committee |

| P | Prospect Committee |

| SPC | Strategic Planning and Compensation Committee |

Amended and Restated Annual Incentive Plan (page 29)

The Company previously sponsored and maintained the

7Matador Resources Company Annual Incentive Plan for Management and Key Employees, effective January 1, 2012. On February 19, 2016, our Board adopted, subject to shareholder approval, the Matador Resources Company Amended and Restated Annual Incentive Plan for Management and Key Employees (the “Incentive Plan”).The Incentive Plan is designed to link executive decision-making and performance with the Company’s goals, reinforce these goals and ensure the highest level of accountability for the success of the Company as a whole. More information regarding the Incentive Plan, including a description thereof, is set forth below beginning on page 29.

|

2024 Proxy Statement

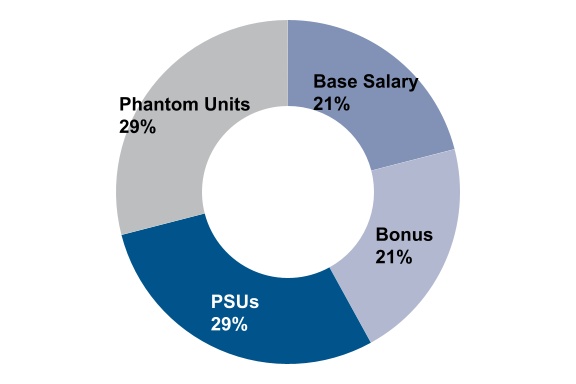

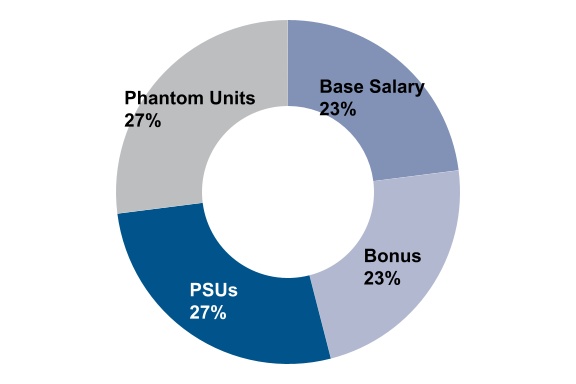

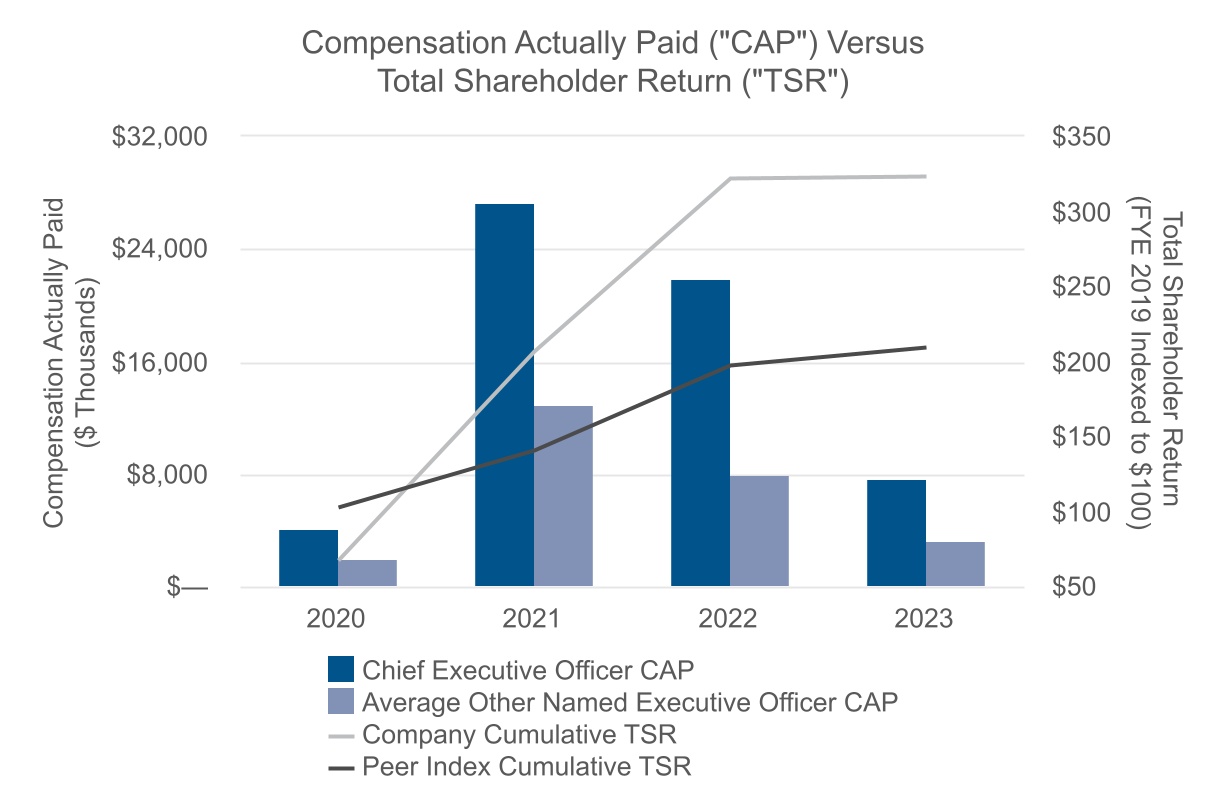

Executive Compensation Highlights (page 43)50)

Our Executive Compensation Philosophy

Our compensation program is designed to reward, in both the short-termshort term and the long-term,long term, performance that contributes to the implementation of our business strategies, maintenance of our culture and values and the achievement of our objectives. In addition, we reward qualities that we believe help achieve our business strategies such as teamwork, as:

•teamwork;

•recruiting and mentoring future leaders within Matador to drive long-term shareholder value;

•individual performance in light of general economic and industry-specificconditions, conditions;

•relationships with shareholders and vendors, vendors;

•level of job responsibility;

•industry experience;

•general professional growth; and

•the ability to to:

◦manage and enhance production from our existing assets, the ability to assets;

◦explore new opportunities to increase oil and natural gas production, the ability to production;

◦identify and acquire additional acreage, the ability to acreage;

◦improve total shareholder returns;

◦increase year-over-year proved reserves, the ability to reserves;

◦control unit production costs, level of job responsibility, industry experiencecosts; and general professional growth.Our Board has

◦pursue midstream opportunities.

For a “pay for performance” philosophy and recognizes the leadership of Mr. Joseph Wm. Foran, our Chairman and Chief Executive Officer, and our other executive officers in contributing to the Company’s success in 2015. Accordingly, approximately 87% of Mr. Foran’s 2015 total compensation was performance based with approximately 57% of his total compensation consisting of long-term incentive awards. Detailsdiscussion of our executive compensation are shown in the 2015 Summaryprogram, see “Executive Compensation— Compensation TableDiscussion and Analysis” beginning on page 56.

50.

8Matador Resources Company | 2024 Proxy Statement

INFORMATION ABOUT THE ANNUAL MEETING

INFORMATION ABOUT THE ANNUAL MEETING

We are furnishing you this Proxy Statement in connection with the solicitation of proxies by the Board to be used at the Annual Meeting and any adjournment thereof. The Annual Meeting will be held on Thursday, June

9, 201613, 2024, at 9:30 a.m., Central Daylight Time. We are sending this Proxy Statement to our shareholders on or about April

28, 2016.26, 2024.

All references in this Proxy Statement to “we,” “our,” “us,” “Matador” or the “Company” refer to Matador Resources Company, including our subsidiaries and affiliates.

What is the purpose of the Annual Meeting?

At the Annual Meeting, shareholders will act upon the

following matters outlined in the Annual Meeting

notice, including the following:notice:•the election of the threefour nominees for director named in this Proxy Statement for a term expiring at the 2019 Annual Meeting of Shareholders;

Statement;the approval of the Company’s Amended and Restated Annual Incentive Plan;

•an advisory vote to approve the compensation of our named executive officers as described herein;

•an advisory vote on the frequency of future advisory votes to approve the compensation of our named executive officers;

•the ratification of the appointment of KPMG LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2016;2024; and

the vote on the shareholder proposal as set forth in this Proxy Statement regarding a majority voting standard for the election of directors; and

•any other matters that may properly come before the meeting.

What are the Board’s voting recommendations?

•FORthe election of the threefour nominees for director named in this Proxy Statement for a term expiring at the 2019 Annual Meeting of Shareholders;Statement;

•FOR the approval of the Company’s Amended and Restated Annual Incentive Plan;

FORthe approval, on an advisory basis, of the compensation of the Company’s named executive officers;

•FOR, on an advisory basis, future advisory votes to approve the compensation of the Company’s named executive officers to occur EVERY YEAR; and

•FOR the ratification of the appointment of KPMG LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2016; and2024.

AGAINST the approval of the shareholder proposal as set forth in this Proxy Statement regarding a majority voting standard for the election of directors.

Shareholders as of the close of business on April

15, 201616, 2024 are eligible to vote their shares at the Annual Meeting. As of the Record Date, there were

93,265,146124,780,249 shares of our Common Stock outstanding. Each share of Common Stock is entitled to one vote at the Annual Meeting.

9Matador Resources Company | 2024 Proxy Statement

Why did I receive a Notice Regarding the Internet Availability of Proxy Materials in the mail instead of a full set of proxy materials?

Securities and Exchange Commission (“SEC”) rules allow companies to furnish proxy materials over the Internet. We have elected to send a separate Notice of Internet Availability of Proxy Materials (the “Notice”) to most of our shareholders instead of a paper copy of the proxy materials. This approach conserves natural

resources and reduces the costs of printing and distributing our proxy materials while providing shareholders with a convenient way to access our proxy materials. Instructions on how to access the proxy materials over the Internet or to request a paper copy of proxy materials, including a proxy card or voting instruction form, may be found in the Notice. In addition, shareholders may request to receive future proxy materials in printed form by mail or electronically by email by following the instructions in the Notice. A shareholder’s election to receive proxy materials by mail or email will remain in effect until the shareholder terminates it.

•attend the Annual Meeting and vote in person; or

•dial the toll-free number listed on the Notice, proxy card or voting instruction form provided by your broker. Easy-to-follow voice prompts allow you to vote your shares and confirm that your voting instructions have been properly recorded. Telephone voting will be available 24 hours a day and will close at 11:59 p.m., Eastern Daylight Time, on June 8, 2016;12, 2024;

•go to the website www.proxyvote.com and follow the instructions, then confirm that your voting instructions have been properly recorded. If you vote using the website, you can request electronic delivery of future proxy materials. Internet voting will be available 24 hours a day and will close at 11:59 p.m., Eastern Daylight Time, on June 12, 2024; or

| • | | go to the websitewww.proxyvote.com and follow the instructions, then confirm that your voting instructions have been properly recorded. If you vote using the website, you can request electronic delivery of future proxy materials. Internet voting will be available 24 hours a day and will close at 11:59 p.m., Eastern Daylight Time on June 8, 2016; or

|

•if you received a paper copy of your proxy materials and elect to vote by written submission, mark your selections on the proxy card, date and sign it, and return the card in the pre-addressed, postage-paid envelope provided.

Why did I receive paper copies of proxy materials?

We are providing certain shareholders with paper copies of the proxy materials instead of a separate Notice. If you received a paper copy and would no longer like to receive printed proxy materials, you may consent to receive all future proxy materials electronically via email or the Internet. To sign up for electronic delivery, please follow the instructions provided in your proxy materials. When prompted, indicate that you agree to receive or access shareholder communications electronically in the future.

Will each shareholder in our household receive proxy materials?

Generally, no. To the extent you are receiving printed proxy materials, we try to provide only one set of proxy materials to be delivered to multiple shareholders sharing an address, unless you have given us other instructions. Any shareholder at a shared address may request delivery of single or multiple copies of printed proxy materials for future meetings by contacting us at:

Matador Resources Company

Attention:

Corporate SecretaryInvestor Relations

5400 LBJ Freeway, Suite 1500

Email: investors@matadorresources.com

Telephone: (972) 371-5200

We undertake to deliver promptly, upon written or oral request, a copy of proxy materials to a shareholder at a shared address to which a single copy of the proxy materials was delivered. Requests should be directed to

the Corporate SecretaryInvestor Relations at the address or phone number set forth above.

10Matador Resources Company | 2024 Proxy Statement

Who will be admitted to the Annual Meeting?

Admission to the Annual Meeting will be limited to our shareholders of record, persons holding proxies from our shareholders, beneficial owners of our Common Stock and our employees. If your shares are registered in your name, we will verify your ownership at the meeting in our list of shareholders as of the Record Date. If your shares are held through a broker, bank or other nominee, you must bring proof of your ownership of the shares. This proof could consist of, for example, a bank or brokerage firm account statement or a letter from your bank or broker confirming your ownership as of the Record Date. You may also send proof of ownership to us at Matador Resources Company, Attention: Corporate Secretary, 5400 LBJ Freeway, Suite 1500, Dallas, Texas 75240, or email: investors@matadorresources.com, before the Annual Meeting, and we will send you an admission card.

If I vote via telephone or the Internet or by mailing my

Proxy Card,proxy card, may I still attend the Annual Meeting?

What if I want to change my vote?

You may revoke your proxy before it is voted by submitting a new proxy with a later date (by mail, telephone or

the Internet), by voting at the Annual Meeting or by filing a written revocation with our Corporate Secretary. Your attendance at the Annual Meeting will not automatically revoke your proxy.

What constitutes a quorum?

A majority of the shares entitled to vote, present in person or represented by proxy, constitutes a quorum. If you vote by telephone or Internet or by returning your

Proxy Card,proxy card, you will be considered part of the quorum. The Inspector of Election will treat shares represented by a properly executed proxy as present at the meeting. Abstentions and broker non-votes will be counted for purposes of determining a quorum. A broker non-vote occurs when a nominee holding shares for a beneficial owner submits a proxy but does not vote on a particular proposal because the nominee does not have discretionary voting power for that item and has not received instructions from the beneficial owner.

How many votes will be required to approve a proposal?

Election

The affirmative vote of a majority of the votes cast by holders of shares of Common Stock present in person or represented by proxy and entitled to vote on the election of directors at the Annual Meeting will be by a plurality of votes cast at the Annual Meeting. Votes may be cast in favor ofis required for the election of each director nominee or withheld.for director. With respect to the election of directors in an uncontested election, such as that being held at the Annual Meeting, “majority of the votes cast” means the number of votes cast “for” such nominee exceeds the number of votes cast “against” such nominee.

With respect to the Frequency Vote, because this vote is non-binding, the choice receiving the greatest number of votes will be considered the frequency recommended by the Company’s shareholders, even if that choice does not receive a majority of the votes.

With respect to all other matters, the affirmative vote of the holders of a majority of the shares

of Common Stock, present in person or

represented by proxy and entitled to vote at the Annual Meeting, is

required to take any other action.required.

Shares cannot be voted at the Annual Meeting unless the holder of record is present in person or

represented by proxy.

11Matador Resources Company | 2024 Proxy Statement

Can brokers who hold shares in street name vote those shares if they have received no instructions?

Under the rules of the New York Stock Exchange (“NYSE”), brokers may not vote the shares held by them in street name for their customers and for which they have not received instructions, except with respect to a routine matter. The only matter to be voted on at the Annual Meeting that is considered routine for these purposes is the ratification of the appointment of our independent registered public accounting firm. Accordingly, brokers may not vote your shares on any other matter if you have not given specific instructions as to how to vote. Please be sure to give specific voting instructions to your broker so that your vote will be counted.

How will you treat abstentions and broker non-votes?

A plurality of the votes cast at the Annual Meeting is required to elect each nominee for director. Accordingly, abstentions and broker non-votes will have no effect on the election of directors.

Shares of a shareholder who abstains from voting on any or all proposals will be included for the purpose of determining the presence of a quorum.

Votes withheldOther than with respect to the election of

directors and the

Company’s directors will have no effect on the election of the nominees. In the case of the other proposals being submitted for shareholder approval,Frequency Vote, an abstention will effectively count as a vote cast against

such proposal.the remaining proposals. Broker non-votes on any matter, as to which the broker has indicated on the proxy that it does not have discretionary authority to vote, will be treated as shares not entitled to vote with respect to that

matter and therefore will have no effect upon the approval of such matter. However, such shares will be considered present and entitled to vote for quorum purposes so long as they are entitled to vote on at least one other matter.

Who pays the solicitation expenses?

We will bear the cost of solicitation of proxies. Proxies may be solicited by mail or personally by our directors, officers or employees, none of whom will receive additional compensation for such solicitation. Those holding shares of Common Stock of record for the benefit of others, or nominee holders, are being asked to distribute proxy soliciting materials to, and request voting instructions from, the beneficial owners of such shares. We will reimburse nominee holders for their reasonable out-of-pocket expenses.

Where can I find the voting results of the Annual Meeting?

We will announce preliminary voting results at the Annual Meeting, and we will publish final results in a Current Report on Form 8-K that will be filed with the SEC within four business days of the Annual Meeting. You may obtain a copy of this and other reports free of charge at

www.matadorresources.com,, by contacting our Investor Relations Department at (972) 371-5200 or investors@matadorresources.com or by accessing the SEC’s website at

www.sec.gov. www.sec.gov.

Will the Company’s independent registered public accounting firm be available at the Annual Meeting to respond to questions?

Yes. The Audit Committee of the Board has approvedappointed KPMG LLP to serve as our independent registered public accounting firm for the year ending December 31, 2016.2024. Representatives of KPMG LLP will be present at the Annual Meeting. They will have an opportunity to make a statement, if they desire to do so, and will be available to respond to appropriate questions.questions

.

Where can I contact the Company?

Matador Resources Company

Attention: Investor Relations

5400 LBJ Freeway, Suite 1500

Our telephone number is (972) 371-5200.

12Matador Resources Company | 2024 Proxy Statement

PROPOSAL 1 —

PROPOSAL 1| ELECTION OF DIRECTORS

The Board currently consists of

nine members. Our Board11 members and is divided into three classes of directors, designated Class I, Class II and Class III, with the term of office of each director ending on the date of the third annual meeting following the annual meeting at which such director’s class was elected. The number of directors in each class will be as nearly equal as

possible at all times.possible. The

current Class I directors are

William M. Byerley, Monika U. Ehrman, Julia P. Forrester Rogers and Kenneth L. Stewart. Each of Ms.

Margaret B. ShannonEhrman and Messrs.

Carlos M. Sepulveda, Jr.Byerley and

George M. Yates, who will hold office until the 2018 Annual Meeting of Shareholders and until the election and qualification of their respective successors or until their earlier death, retirement, resignation or removal. TheStewart is a Class

II directors are Messrs. Gregory E. Mitchell and Don C. Stephenson and Dr. Steven W. Ohnimus. Mr. Stephenson’s term will expireI director nominee at the

Annual Meeting, creating a vacancy on the Board. Messrs. Craig T. Burkert and Mitchell and Dr. Steven W. Ohnimus are the Class II director nominees at the Annual Meeting. The Class III directors are Messrs. Joseph Wm. Foran, David M. Laney and Reynald A. Baribault, who will hold office until the 2017 Annual Meeting of Shareholders and until the election and qualification of their respective successors or until their earlier death, retirement, resignation or removal.Mr. Burkert has been nominated by the Board for election as a Class II director at the Annual Meeting and Mr. Mitchell and Dr. Ohnimus have been nominated by the Board for re-election as Class II directors at the2024 Annual Meeting, in each case, to hold office until the 20192027 Annual Meeting of Shareholders and until the election and qualification of their respective successors or until theirhis or her earlier death, retirement, resignation or removal.

Ms. Rogers’ term will expire at the 2024 Annual Meeting. The Class II directors are Shelley F. Appel, R. Gaines Baty, James M. Howard and Susan M. Ward. The terms of Ms. Appel and Messrs. Baty and Howard will each continue until the 2025 Annual Meeting of Shareholders or his or her earlier death, retirement, resignation or removal. Ms. Ward was appointed to the Board following the 2023 Annual Meeting and is therefore a Class II nominee at the 2024 Annual Meeting, to hold office until the 2025 Annual Meeting of Shareholders or her earlier death, retirement, resignation or removal. The Class III directors are Joseph Wm. Foran, Reynald A. Baribault and Timothy E. Parker, the terms of whom will each continue until the 2026 Annual Meeting of Shareholders or his earlier death, retirement, resignation or removal.

The Board believes that each of the director nominees possesses the qualifications described below in “Corporate Governance — Governance—Board Committees — Committees—Nominating Compensation and Planning Committee.” That is, the Board believes that each nominee possesses: (i)

•deep experience at the policy making level in business, government or education; (ii)

•the availability and willingness to devote adequate time to Board duties; (iii)

•the character, judgment and ability to make independent analytical, probing and other inquiries; (iv)

•a willingness to exercise independent judgment along with a willingness to listen and learn from others; (v)

•business knowledge and experience that provides a balance with the other directors; (vi)

•financial independence; and (vii) with respect to incumbent directors,

•excellent past performance on the Board.

13Matador Resources Company | 2024 Proxy Statement

Director Skills & Experience

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Foran | Parker | Baty | Appel | Baribault | Byerley | Ehrman | Howard | Rogers | Stewart | Ward |

| Director Skills & Experience |

| Senior Leadership | • | • | • | | • | • | • | • | • | • | • |

| Energy Industry | • | • | | • | • | • | • | • | | • | • |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Finance & Accounting | • | • | | • | • | • | | • | | • | • |

| Human Capital Management | • | • | • | | • | • | • | | • | • | • |

| Legal, Regulatory & Environmental | • | • | | • | • | • | • | | • | • | • |

| Risk Assessment & Management | • | • | • | • | • | • | • | • | • | • | • |

| Strategic Planning | • | • | • | • | • | • | • | | • | • | • |

| Corporate Governance & Ethics | • | • | • | • | • | • | • | • | • | • | • |

| Capital Markets & M&A | • | • | | • | • | • | | • | | • | • |

| Demographic Background |

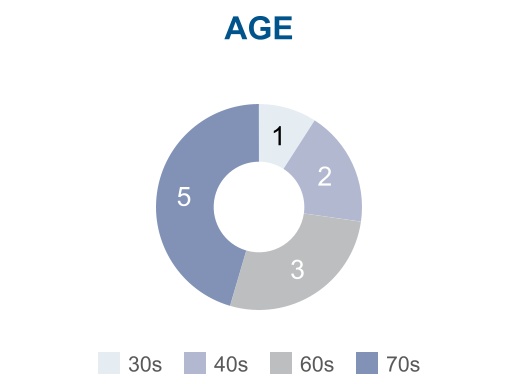

| Board Tenure | 21 | 6 | 8 | 1 | 10 | 8 | 5 | 3 | 7 | 7 | 0 |

Age1 | 71 | 49 | 73 | 34 | 60 | 70 | 46 | 73 | 64 | 70 | 65 |

| Gender Diversity | | | | • | | | • | | • | | • |

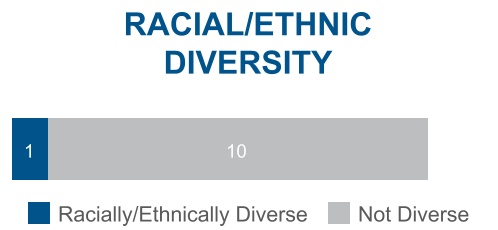

| Racial/Ethnic Diversity | | | | | | | • | | | | |

(1) As of April 16, 2024.

The information provided below is biographical information about each of the nominees, as well as a description of the experience, qualifications, attributes or skills that led the Board to conclude that the individual should be nominated for election as a director of the Company.

Nominees

Mr. Craig T. Burkert. Mr. Burkert, age 59, No director or director nominee currently holds, or has been nominated for election by the Board as a Class II director at the Annual Meeting. With over 30 years of experience in distribution businesses, he currently serves as the Chief Financial Officer of ROMCO Equipment Co., a dealer of heavy construction equipment that serves customers in a variety of sectors throughout most of Texas. Mr. Burkert joined ROMCO in 1984 as a Product Manager, later serving as a Branch Manager from 1986 to 1989 and as General Manager from 1989 to 1994. In 1994 he left ROMCO to start a dealership in the lift truck industry in New England, but he returned to ROMCO in 2003 to take on his current position of Chief Financial Officer, where he is responsible for all financial, administrative and technology aspects of the company. Mr. Burkert has been involved with Matador since its inception. He has served on the Shareholder Advisory Committee for Board Nominations since 2014, has acted as a special advisor to the Company for midstream related matters and is an active participant in shareholder meetings and various Board activities. Mr. Burkert’s accounting and financial knowledge and leadership experience, coupled with his familiarity with the operations and corporate governance of the Company, provides our Board with a valuable perspective on these matters and other business issues.

Mr. Gregory E. Mitchell. Mr. Mitchell, age 64, joined our Board in June 2011. With 47 years of grocery and petroleum retailing experience, he is currently President and Chief Executive Officer of Toot’n Totum Food Stores, LLC, his family company located in Amarillo, Texas. The company, founded in 1950, consists of over 100 convenience stores, car washes, lube centers and check cashing locations, with an employee base of over 1,000 team members in the organization. His experienceheld within the petroleum industry includes extensive

negotiationspast five years, any other directorships with various major refiners in the United States. A 1973public companies.

14Matador Resources Company | 2024 Proxy Statement

PROPOSAL 1

Nominees

| | | | | | | | |

MR. WILLIAM M. BYERLEY | Retired Partner, PricewaterhouseCoopers LLP (PwC) | Class I |

| | |

| Biographical Information: | |

| Mr. Byerley was appointed to the Board in 2016 and is chair of the Board’s Audit Committee. Mr. Byerley retired from PricewaterhouseCoopers LLP (PwC) in 2014. From 1988 through 2014, Mr. Byerley was a Partner with PwC, serving as an Assurance Partner on various audit engagements primarily for energy sector clients. From 1988 through 1990, Mr. Byerley served in the PwC National Office Accounting Services Group. Mr. Byerley received a Bachelor of Business Administration degree in 1975 and a Master of Business Administration degree in 1976, both from Southern Methodist University. He is a licensed Certified Public Accountant. |

|

|

|

|

|

|

| | |

| Director | | |

Director since: 2016 | | |

Independent: Yes | | |

Age: 70 | | |

| Committees: | Qualifications: |

•Audit (Chair) | Mr. Byerley’s extensive experience in public accounting and longtime service to energy sector clients of PwC provide the Board with invaluable financial and accounting expertise, particularly for oil and natural gas companies, as well as strong accounting and financial oversight and risk management expertise. |

•Environmental, Social and Corporate Governance |

•Marketing and Midstream |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

15Matador Resources Company | 2024 Proxy Statement

| | | | | | | | |

MS. MONIKA U. EHRMAN | Professor of Law, Southern Methodist University Dedman School of Law | Class I |

| | |

| Biographical Information: | |

| Professor Ehrman was appointed to the Board in 2019 and is co-chair of the Board’s Marketing and Midstream Committee. She is Professor of Law, Southern Methodist University Dedman School of Law, and a Professor of Engineering (by courtesy), Southern Methodist University Lyle School of Engineering. Prior to joining SMU, in 2023, she was Associate Professor of Law, University of North Texas at Dallas College of Law and a tenured Professor of Law at the University of Oklahoma College of Law, where she led the Oil & Gas, Natural Resources, and Energy (ONE) Program and served as the Faculty Director of the ONE Center. While at OU, she taught in the J.D. and graduate programs at the College of Law and in the Executive Energy Management Program at the Price College of Business. Professor Ehrman joined the University of Oklahoma College of Law in 2013 as Associate Professor of Law. Prior to teaching, she served as in-house legal counsel for two oil and natural gas companies from 2008 to 2012 and as an associate oil and natural gas attorney at an international law firm from 2005 to 2008. Before law school, Professor Ehrman worked as a petroleum engineer in the upstream, midstream and pipeline sectors of the energy industry. In addition to serving on various oil and natural gas law committees, she also served as an Editor of the Oil and Gas Reporter for the Institute for Energy Law. Professor Ehrman is currently Treasurer and on the Executive Committee of the Foundation for Natural Resources and Energy Law, and she is on the Editorial Board of the Journal of World Energy Law & Business (published by Oxford University Press). Professor Ehrman received her Bachelor of Science degree in Petroleum Engineering from the University of Alberta; J.D. from Southern Methodist University Dedman School of Law; and Master of Laws degree from Yale Law School. |

|

|

|

|

|

|

|

| Director |

Director since: 2019 |

Independent: Yes |

Age: 46 |

| Committees: |

•Marketing and Midstream (Co-Chair) |

•Environmental, Social and Corporate Governance |

•Executive |

•Operations and Engineering |

•Prospect |

•Strategic Planning and Compensation |

|

|

| Qualifications: |

| Professor Ehrman provides valuable insight to our Board on our engineering and midstream operations as well as legal and governance matters. |

|

|

16Matador Resources Company | 2024 Proxy Statement

| | | | | | | | |

MR. KENNETH L. STEWART | Retired EVP, Compliance and Legal Affairs, Children’s Health System of Texas; Retired Partner, Chair—United States, Norton Rose Fulbright US LLP | Class I |

| | |

| Biographical Information: | |

| Mr. Stewart was appointed to the Board in 2017. Mr. Stewart was most recently employed as Executive Vice President, Compliance and Legal Affairs, for Children’s Health System of Texas from January 1, 2019 until he retired on January 2, 2021. At that time, Children’s Health System of Texas and its affiliates constituted one of the ten largest pediatric hospital systems in the United States. Previously, effective December 31, 2018, Mr. Stewart retired from Norton Rose Fulbright US LLP, the United States operations of Norton Rose Fulbright, an international legal practice, which then had over 3,700 legal professionals in over 50 cities worldwide. At his retirement, Mr. Stewart was a Partner with Norton Rose Fulbright and held the position of Chair—United States. Mr. Stewart began his legal career with Fulbright & Jaworski LLP, the predecessor to Norton Rose Fulbright US LLP, and previously held positions of Global Chair of the international organization, Managing Partner of the United States region and Partner-in-Charge of the Dallas office. Prior to entering into full-time management for his firm in 2012, he engaged in a domestic and international transactional legal practice, focusing principally on merger, acquisition, financing and joint venture activities for both public and privately-held entities. Mr. Stewart has extensive experience representing and advising companies and their executive officers and boards of directors engaged in oil and natural gas exploration and midstream activities. Since his retirement from Norton Rose Fulbright, Mr. Stewart has acted, and from time to time continues to act, on a limited basis as an independent contractor senior business consultant to family offices for which he provided services during his legal career. Mr. Stewart graduated from the University of Arkansas School of Business in 1976 with a Bachelor of Science in Business Administration degree in Accounting and was licensed as a Certified Public Accountant in Texas in 1981 (certificate now on non-practice status). He graduated with honors from Vanderbilt Law School in 1979 and was a member of the Order of the Coif. Mr. Stewart has been active in numerous civic and professional organizations in the Dallas area in the past, including among others, the Dallas Regional Chamber, The Center for American and International Law and the Dallas Citizens Council. |

|

|

|

|

|

|

|

| Director |

Director since: 2017 |

Independent: Yes |

Age: 70 |

| Committees: |

•Capital Markets and Finance |

•Environmental, Social and Corporate Governance |

•Executive |

•Strategic Planning and Compensation |

|

|

|

|

|

|

| | |

| Qualifications: |

| Mr. Stewart’s extensive experience representing public companies, and particularly oil and natural gas companies, along with his years of management experience, provide our Board with important legal, corporate governance and leadership insight. |

|

|

17Matador Resources Company | 2024 Proxy Statement

| | | | | | | | |

MS. SUSAN M. WARD | Former Head, M&A and Commercial Finance, Shell Oil Company | Class II |

| | |

| Biographical Information: | |

| Ms. Ward was appointed to the Board in 2024. Ms. Ward is a former 12-year Senior Executive of Shell Oil Company (“Shell”) with over 20 years of service at retirement in 2019. Her senior roles at Shell included Head, M&A and Commercial Finance for all of Shell’s businesses in the Americas; Vice President, Chief Financial Officer and Board member of Shell Midstream Partners, which she helped take public for Shell in 2014; and Vice President, Upstream Commercial Finance, Shell International Exploration & Production B.V. while based in The Hague for Royal Dutch Shell. She also served as a Board member of Shell’s deepwater drillship joint venture with Noble Corporation. Ms. Ward has been an independent, non-executive Board member of Crescent Midstream (“Crescent”) since July 2023. Crescent is an independent energy company providing offshore and onshore crude oil services in the Gulf of Mexico and Louisiana. Prior to joining Shell in 1998, Ms. Ward worked as an investment banker in the energy sector for 11 years, including as a Managing Director in the Natural Resources and Energy investment banking group of UBS Securities. She began her career working for Exxon as a refining process engineer and subsequently worked in Mobil’s Finance organization at its New York City headquarters. Ms. Ward earned a Bachelor of Chemical Engineering degree from Villanova University with honors and a Master of Business Administration in Finance with distinction from the Wharton School of the University of Pennsylvania. She has served on Villanova’s Board of Trustees since 2018. She has been a member of the National Association of Corporate Directors since 2016. |

|

|

|

|

|

|

|

| Director |

Director since: 2024 |

Independent: Yes |

Age: 65 |

| Committees: |

•Audit |

•Environmental, Social and Corporate Governance |

•Marketing and Midstream |

•Prospect |

|

| | |

| Qualifications: |

| Mr. Ward’s extensive experience as a senior executive in the energy industry and midstream experience in particular provide our Board with industry, management and leadership insight. |

|

|

Vote Required

The affirmative vote of

the University of Oklahoma with a

Bachelor of Business Administration degree, Mr. Mitchell was appointed by former Governor William Clements to the Texas Higher Education Coordinating Board, where he served from 1987 through 1993. Additionally, he has served as Chairman of the Amarillo Chamber of Commerce, Chairman of the United Way of Amarillo and Canyon, Chairman of the Harrington Foundation and President of the Amarillo Area Foundation. Mr. Mitchell is a former director of the Holding Committee of Amarillo National Bank, former board member of Cal Farley’s Boys Ranch and former Chairman of the Cal Farley’s Boys Ranch Foundation. Mr. Mitchell’s experience as President and Chief Executive Officer of his large family business provides our Board with extensive business, strategic and executive leadership experience.Dr. Steven W. Ohnimus. Dr. Ohnimus, age 69, was first elected to our Board in January 2004. He spent his entire professional career from 1971 to 2000 with Unocal Corporation, an integrated energy company. From 1995 to 2000, he was General Manager — Partner Operated Ventures, where he represented Unocal’s non-operated international interests at board meetings, management committees and other high level meetings involving projects in the $200 million range in countries such as Azerbaijan, Bangladesh, China, Congo, Myanmar and Yemen. From 1994 to 1995, Dr. Ohnimus was General Manager of Asset Analysis, where he managed and directed planning, business plan budgeting and scenario plans for the domestic and international business unit with an asset portfolio totaling $5.5 billion. From 1990 to 1994, Dr. Ohnimus was Vice President and General Manager, Unocal Indonesia, located in Balikpapan, operating five offshore fields and one onshore liquid extraction plant and employing 1,200 nationals and 50 expatriates. From 1989 to 1990, he served as Regional Operations Manager in Anchorage, Alaska, and from 1988 to 1989, he was District Operations Manager in Houma, Louisiana. From 1981 to 1988, Dr. Ohnimus was in various management assignments in Houston and Houma, Louisiana, and from 1971 to 1981 he handled various technical assignments in reservoir engineering, production and drilling in the Gulf Coast area (Houston, Van, Lafayette and Houma). From 1975 to 1979, Dr. Ohnimus was Assistant Professor of Petroleum Engineering at the University of Southwest Louisiana (now University of Southern Louisiana) where he taught eleven undergraduate and graduate night classes. In 1980, he taught drilling seminars at the University of Texas Petroleum Extension Service of the International Association of Drilling Contractors (“IADC”). Dr. Ohnimus has authored several published papers concerning reservoir recompletion and increased recovery. He received his Bachelor of Science degree in Chemical Engineering from the University of Missouri at Rolla in 1968, a Master of Science degree in Petroleum Engineering from the University of Missouri at Rolla in 1969 and a PhD degree in Petroleum Engineering from the University of Missouri at Rolla in 1971. Dr. Ohnimus served as a director of the American Petroleum Institute in 1978 and 1979, served as Session Chairman for the Society of Petroleum Engineers’ Annual Convention in 1982, was the Evangeline Section Chairman of the Society of Petroleum Engineers in 1978 and 1979 and served as President of the Unocal Credit Union from 1986 to 1988. In 2007, he was elected President of the Unocal Gulf Coast Alumni Club, which reports through the Chevron Retirees Association, for which Dr. Ohnimus is a director. Effective July 2015, Dr. Ohnimus assumed the position of South Texas Area Vice President of the Chevron Retirees Association. From 2008 to 2009, Dr. Ohnimus served as the vice chairman of the advisory board of Western Standard Energy Corp. (OTCBB: WSEG), an oil and natural gas exploration company. Due to his long oil and natural gas industry career and significant operational and international experience, Dr. Ohnimus provides valuable insight to our Board on our drilling and completion operations and management, as well as providing a global technology and operations perspective.

Vote Required

To be elected as a director, each director nominee must receive a pluralitymajority of the votes cast by the shareholdersholders of shares present in person or represented by proxy and entitled to vote on the election of directors at the Annual Meeting is required for the election of directors.each nominee for director. With respect to the election of directors in an uncontested election, such as that being held at the Annual Meeting, “majority of the votes cast” means the number of votes cast “for” such nominee exceeds the number of votes cast “against” such nominee. If you hold your shares through a broker and you do not instruct the broker how to vote, your broker will not have the authority to vote your shares. Abstentions and broker non-votes will each be counted as present for purposes of determining the presence of a quorum but will have no effect upon the outcome of the vote.

quorum. The Board of Directors recommends that you vote FOR each of the nominees.

18Matador Resources Company | 2024 Proxy Statement

PROPOSAL 1

Directors Continuing in Office

Biographical information for our directors who are continuing in office is provided below.

Mr. Reynald A. Baribault. Mr. Baribault, age 52, was elected to our Board in June 2014 and currently serves as the chair of the Board’s Operations and Engineering Committee. He is Vice President / Engineering of North Plains Energy, LLC, a Denver-based exploration and production operator he co-founded in 2007. North Plains Energy’s operations are solely focused on the Bakken play in North Dakota. In addition, he co-founded and serves as President and Chief Executive Officer of IPR Energy Partners, LLC, a Dallas-based oil and natural gas production operator with past operations in Louisiana, Southeast New Mexico and North Central Texas and current operations in the Fort Worth Basin. Prior to co-founding North Plains Energy and IPR Energy Partners, Mr. Baribault served as Vice President, Supervisor and Petroleum Engineering Consultant of Netherland, Sewell & Associates, Inc. from 1990 to 2002. Mr. Baribault began his professional career with Exxon Company in 1985 and oversaw operations reservoir engineering matters for high-pressure natural gas fields in South Louisiana. Mr. Baribault received his Bachelor of Science degree in Petroleum Engineering from Louisiana State University in 1985 and is a registered Petroleum Engineer in the State of Texas. Mr. Baribault provides valuable insight to our Board on our drilling, completion and reservoir engineering operations.

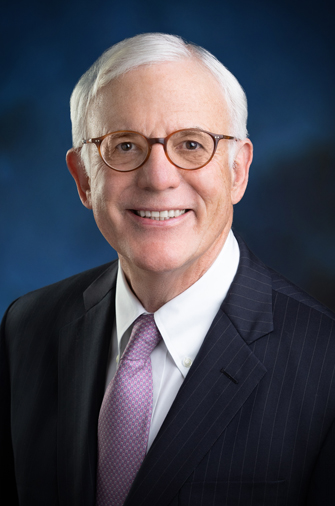

Mr. Joseph Wm. Foran.

| | | | | | | | |

MR. JOSEPH WM. FORAN | Chairman and CEO, Matador Resources Company | Class III |

| | |

| Biographical Information: | |

Mr. Foran age 63, founded Matador Resources Company in July 2003 and since our founding has served as Chairman of the Board and Chief Executive Officer and, through March 31, 2022, Secretary. He is also chair of the Board’s Executive Committee. Mr. Foran began his career as an oil and natural gas independent in 1983 when he and his wife, Nancy, founded Foran Oil Company with $270,000 in contributed capital from 17 of his closest friends and neighbors. Foran Oil Company was later contributed into Matador Petroleum Corporation upon its formation by Mr. Foran in 1988, and Mr. Foran served as Chairman and Chief Executive Officer of that company from inception until the time of its sale to Tom Brown, Inc. in June 2003 for an enterprise value of $388 million in an all-cash transaction on a Friday. On the following Monday, Mr. Foran founded Matador Resources Company (Matador II). Today, Matador is one of the top 20 public exploration and production companies in the country by market capitalization and one of the top 10 oil and natural gas producers in New Mexico. Mr. Foran is originally from Amarillo, Texas, where his family owned a pipeline construction business. From 1980 to 1983, he was Vice President and General Counsel of J. Cleo Thompson and James Cleo Thompson, Jr., Oil Producers, a large independent producer. Prior to that time, he was a briefing attorney to Chief Justice Joe R. Greenhill of the Supreme Court of Texas. Mr. Foran graduated with a Bachelor of Science degree in Accounting from the University of Kentucky with highest honors and a law degree from the Southern Methodist University Dedman School of Law, where he was a Hatton W. Sumners scholar and the Leading Articles Editor on the Southwestern Law Review. He is currently active as a member of various industry and civic organizations, including his church and various youth activities. In 2002, Mr. Foran was honored as the Ernst & Young “Entrepreneur of the Year” for the Southwest Region. In 2015, he was inducted into the University of Kentucky Gatton College of Business and Economics Hall of Fame. In 2019, Mr. Foran received the SMU Dedman School of Law Distinguished Alumni Award for Corporate Service and was named D CEO Magazine’s 2019 Upstream CEO of the Year. In 2020, he was inducted into the Philosophical Society of Texas. He was also named to Institutional Investors’ All-American Executive Team as one of the top chief executive officers in the Small Cap Energy Division in 2021. |

|

|

|

|

|

|

|

| Chairman of the Board |

Director since: 2003 |

Independent: No |

Age: 71 |

| Committees: |

•Executive (Chair) |

•Capital Markets and Finance |

•Operations and Engineering |

•Prospect |

|

|

|

|

|

|

|

|

|

|

|

| | |

| Qualifications: |

| As the founder, Chairman of the Board and Chief Executive Officer of Matador Resources Company, Mr. Foran provides Board leadership, industry experience and long relationships with many of our shareholders. |

|

|

19Matador Resources Company in July 2003 and has served as Chairman of the Board, Chief Executive Officer and Secretary since our founding. He served as President from our founding until November 2013 and is also chair of the Board’s Executive Committee. Mr. Foran began his career as an oil and natural gas independent in 1983 when he and his wife, Nancy, founded Foran Oil Company with $270,000 in contributed capital from 17 of his closest friends and neighbors. Foran Oil Company was later contributed into Matador Petroleum Corporation upon its formation by Mr. Foran in 1988, and Mr. Foran served as Chairman and Chief Executive Officer of that company from inception until the time of its sale to Tom Brown, Inc. in June 2003 for an enterprise value of $388 million in an all-cash transaction. Under Mr. Foran’s guidance, Matador Petroleum realized a 21% average annual rate of return for its shareholders for 15 years. Mr. Foran is originally from Amarillo, Texas, where his family owned a pipeline construction business. From 1980 to 1983, he was Vice President and General Counsel of J. Cleo Thompson and James Cleo Thompson, Jr., Oil Producers. Prior to that time, he was a briefing attorney to Chief Justice Joe R. Greenhill of the Supreme Court of Texas. Mr. Foran graduated with a Bachelor of Science degree in Accounting from the University of Kentucky with highest honors and a law degree from the Southern Methodist University Dedman School of Law, where he was a Hatton W. Sumners scholar and the Leading Articles Editor of the Southwestern Law Review. He is currently active as a member of various industry and civic organizations, including his church and various youth activities. In 2002, Mr. Foran was honored as the Ernst & Young “Entrepreneur of the Year” for the Southwest Region. As the founder, Chairman of the Board and Chief Executive| 2024 Proxy Statement

| | | | | | | | |

MS. SHELLEY F. APPEL | Former Senior Investors Relations Officer and Mergers & Acquisitions Manager, Royal Dutch Shell PLC | Class II |

| | |

| Biographical Information: | |

| Ms. Appel was appointed to the Board in 2023 after serving as a Special Advisor to the Board since October 2022. Since January 2021, Ms. Appel has also served as Matador’s Environmental, Social and Governance (“ESG”) Coordinator. As ESG Coordinator, Ms. Appel is the primary author of the Company’s annual sustainability report. Following her graduation from business school at the University of Chicago, Ms. Appel joined Royal Dutch Shell PLC in August 2017 in the Mergers & Acquisitions group, where she served as a manager with responsibility for financial analysis—including valuation, structuring, negotiation and due diligence—for over $18 billion of acquisition and divestment opportunities. In December 2019, Ms. Appel was promoted to Senior Investor Relations Officer. In this role, Ms. Appel had responsibility for Shell’s global Upstream business narrative. She also served as an authorized spokesperson for Shell at investor meetings and conferences and managed relationships with North America based investors and research analysts. Following graduation from Yale and prior to attending the University of Chicago, Ms. Appel began her career at the parent company of the New York Stock Exchange, NYSE Euronext, as a business analyst in its Corporate Strategy group. She participated in the evaluation and implementation of its $11 billion merger with the Intercontinental Exchange Group and continued in the Corporate Strategy group of the combined company until June 2015. Ms. Appel holds a Bachelor of Arts degree, with honors, in Cognitive Science from Yale University and a Master of Business Administration degree from the Booth School of Business (University of Chicago). Ms. Appel served as Co-Chair of the Energy Group while attending the University of Chicago. |

|

|

|

|

|

|

|

| Director |

Director since: 2023 |

Independent: No |

Age: 34 |

| Committees: |

•Capital Markets and Finance |

|

|

|

| | |

| Qualifications: |

| Ms. Appel’s extensive knowledge and experience with the Company’s Environmental, Social and Governance initiatives and investor relations experience provides the Board valuable insight and leadership on these matters. |

|

|

20Matador Resources Company Mr. Foran has provided leadership, experience and long relationships with many of our shareholders.Mr. David M. Laney. Mr. Laney, age 67, is an original shareholder|

2024 Proxy Statement

| | | | | | | | |

MR. REYNALD A. BARIBAULT | President and CEO, IPR Energy Partners LLC | Class III |

| | |

| Biographical Information: | |

| Mr. Baribault was elected to the Board in 2014 and is chair of the Board’s Operations and Engineering Committee and Prospect Committee. He served as lead independent director of the Board from 2016 to 2019. In 2007, he co-founded North Plains Energy, LLC, which operated in the North Dakota Williston Basin, and served as its Vice President until the successful sale of its assets in 2012. In 2014, Mr. Baribault helped co-found NP Resources, LLC, which also operated in the North Dakota Williston Basin, and served as its Executive Vice President / Engineering, helping oversee the sale of its assets in late 2021. In addition, he co-founded and serves as President and Chief Executive Officer of IPR Energy Partners, LLC, a Plano, Texas-based oil and natural gas production operator with current operations in the Fort Worth Basin. Prior to co-founding North Plains Energy, NP Resources and IPR Energy Partners, Mr. Baribault served as Vice President, Supervisor and Petroleum Engineering Consultant with Netherland, Sewell & Associates, Inc. in their Dallas office from 1990 to 2002. Mr. Baribault began his professional career as a reservoir engineer with Exxon Company in 1985 in the New Orleans Eastern Division Office. Mr. Baribault received his Bachelor of Science degree in Petroleum Engineering from Louisiana State University in 1985 and is a Licensed Professional Engineer in the State of Texas. |

|

|

|

|

|

|

|

| Director |

Director since: 2014 |

Independent: Yes |

Age: 60 |

| Committees: |

•Operations and Engineering (Chair) |

•Prospect (Chair) |

•Audit |

•Executive | Qualifications: |

•Nominating | Mr. Baribault provides valuable insight to our Board on our drilling, completions, production and reservoir engineering operations, as well as growth strategies, midstream operations and administration. |

•Strategic Planning and Compensation |

|

| | |

21Matador Resources Company and was an original shareholder in Matador Petroleum Corporation.| 2024 Proxy Statement

| | | | | | | | |

MR. R. GAINES BATY | CEO, R. Gaines Baty Associates, Inc. | Class II |

| | |

| Biographical Information: | |